gift in kind tax

Form 8283 is used to claim a deduction. You choose whether to report each years earnings or wait to report.

Short On Cash Gift In Kind Donations Can Also Help Support Charities Carr Riggs Ingram Cpas And Advisors

The gift tax is a tax on the transfer of property by one individual to another while receiving nothing or less than full value in return.

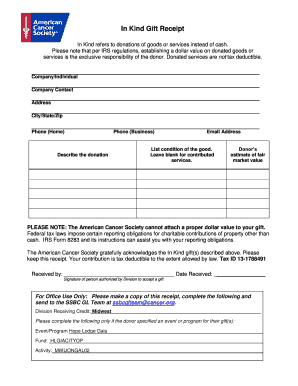

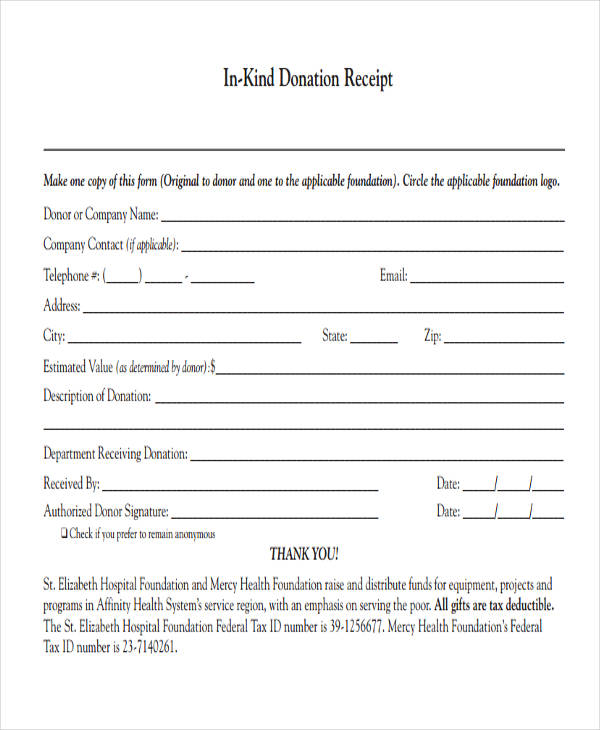

. Examples in this group are office furniture computer hardware and software and supplies. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture. Updated June 03 2022.

The exemption for 2022 is 1206 million. State and local income tax. As a guide a gift not exceeding 200 is considered to be not substantial in value.

Previously till 30092009 as per section 56 2 vi of the Income Tax Act- 1961 the sum of money received without consideration only was taxable. The Income Tax Act 1961 Act which is levies tax on incomes that is revenue receipts carves out certain exceptions and levies tax. A gift-in-kind is a voluntary transfer of property other than cash without consideration.

If the gift exceeds the exemption threshold the full value is taxable. There are three general types of in-kind gifts. See Applying the Exemption.

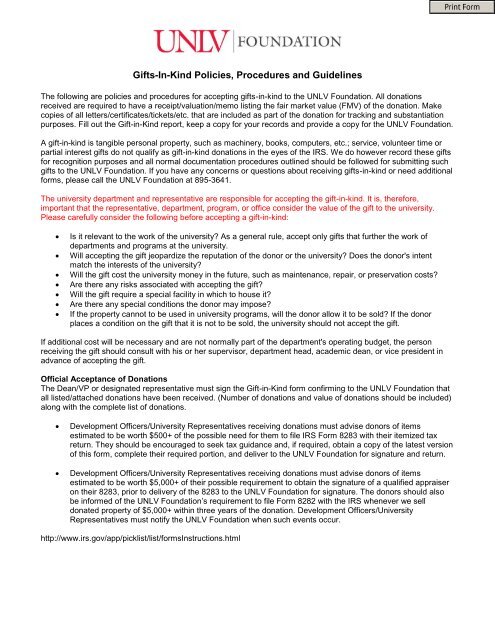

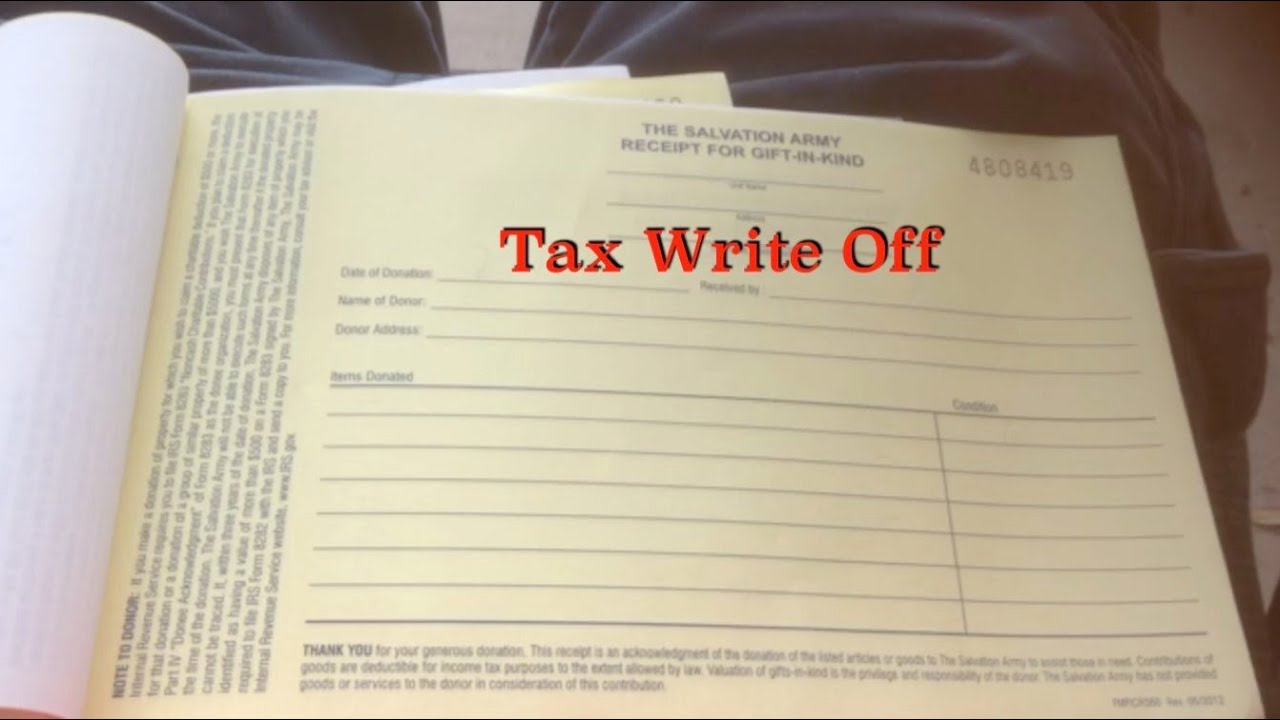

Criteria for Gifts-In-Kind. Example gifts-in-kind NFP financial statement disclosures AICPA 2022 Nonprofit Audit Guide National Council of Nonprofits Disclaimer. In order to get a tax receipt for a Gift-In-Kind the donation needs to be actual property.

10 of 500 is 50. Therefore the advantage must be 50 or less. Gifts are usually capital receipts by nature.

Gift in kind was outside the. Information about Form 8283 Noncash Charitable Contributions including recent updates related forms and instructions on how to file. Amount and types of deductible contributions.

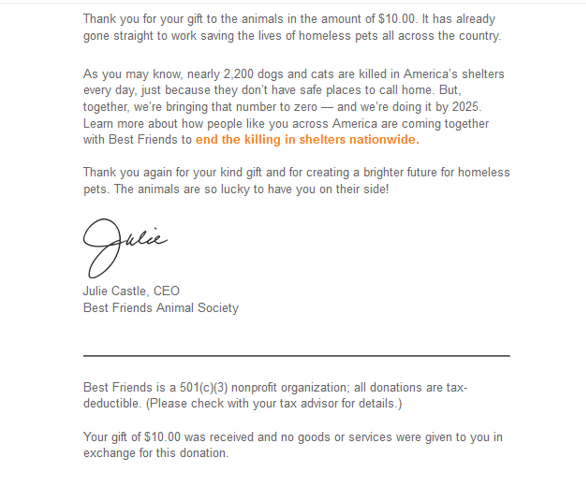

One of the first steps in understanding how to record and communicate your in-kind gifts is determining. For tax purposes gifts in kind can only be valued at the actual expense to the donor of providing the gift. Tax-deductible donations are typically gifts contributed to organizations that in the US the IRS recognizes as exempt.

A searchable database of organizations eligible to receive tax-deductible charitable contributions. In-Kind vs Monetary Donations. Since the standards for recognizing contributions at their fair value were issued in 1993 NFPs have been challenged to measure the value of the myriad contributions they.

This article is for informational. The following calculations are used to determine the eligible amount of the gift for receipting purposes. This includes physical belongings and even real estate.

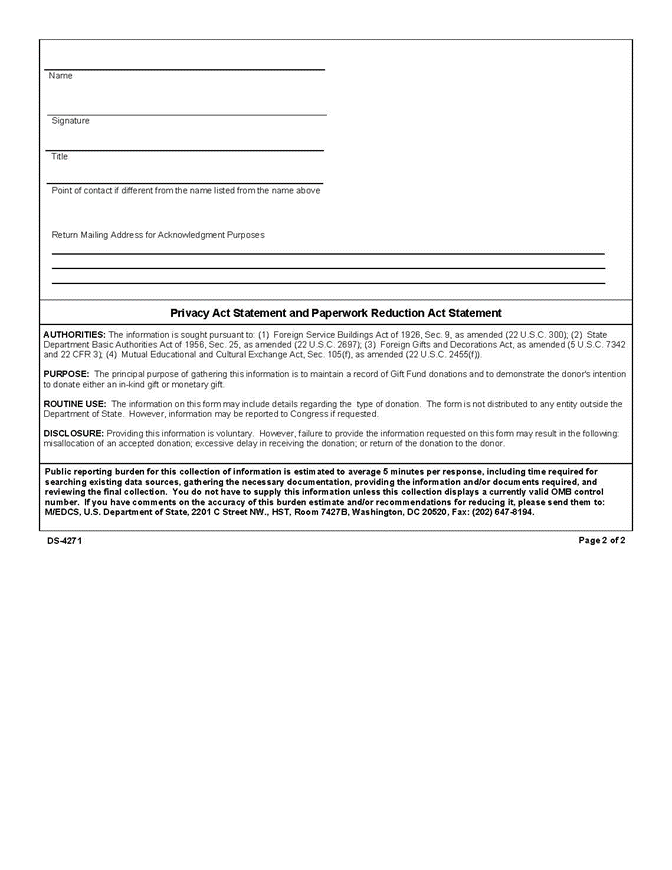

Gift-in-Kind Acceptance Form LCC Foundation 4000 E 30th Ave Building 19 Room 270 Eugene OR 97405 Revised 7302015 Page 1 of 2 To Be Completed By Lane Community College Staff. Determine whether youre required to acknowledge in-kind gifts. Federal estate gift and excise taxes.

State estate or inheritance taxes. The donor would need to be able to prove the actual expense. It includes numerous types of property in particular inventory capital property and depreciable property.

According to IRS regulations it is the donors responsibility to value an in-kind contribution and the IRS requires a qualified written appraisal to be attached to the individuals.

Fillable Online Acsmwdcr Ejoinme In Kind Gift Receipt Acsmwdcr Ejoinme Org Fax Email Print Pdffiller

Complete Guide To Donation Receipts For Nonprofits

23 Printable Donation Receipt For Tax Purposes Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Calameo Example Gift In Kind Form

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Free 10 Gift Receipt Templates In Pdf Ms Word Excel

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

2022 Car Donation Tax Deduction Information

Gifts In Kind Australian Shepherd Health Genetics Institute

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Donor Acknowledgment Letters What To Include

Your Complete Guide To In Kind Donations

Hokie Club Donor Guide Book By Virginia Tech Athletics Issuu

Filling Out A Tax Receipt At The Salvation Army Youtube

In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch

Get Our Image Of Gift In Kind Receipt Template Receipt Template Marketing Strategy Template Sales And Marketing Strategy